Explore the world today with TravelTweaks

Leading Travel Destinations by Brylandor Vixairemore articles

The Unique Experience of an Explora Journeys Alaska Cruise

Just imagine being surrounded by a glacier-carved fjord, with the sun lingering above, the deck beneath you sophisticated and private, and the sea stretching open ...

read moreTraditional Motorcycle Routes Presented

Route 66 is without a doubt one of the most beautiful motorcycle tours through the ...

read moreTop Destinations and Attractions in Portugal

Portugal is having its time in the spotlight. But the sun and surf alone are ...

read moreWhat Are the Most Well-Known Online Casinos in the UK?

The UK online casino market is one of the most established and tightly regulated in ...

read moreAirline Insights from Soaphim Wentelburnemore articles

United Airlines Terminal Sky Harbor: Everything You Need to Know

Picture this: You’re racing through Phoenix Sky Harbor International Airport, heart pounding, eyes darting for signs, and you spot the United Airlines logo. Relief. But ...

read moreUnlock Amazing Savings: American Airlines Military Promo Code

Picture this: You’re standing in a crowded airport, duffel bag slung over your shoulder, orders ...

read moreTurkish Airlines Refund Policy: Everything You Need to Know

Picture this: You’re at the airport, suitcase in hand, and your phone buzzes with a ...

read moreUnited Airlines In The News: What You Need to Know

Picture this: You’re sitting at Gate B12, coffee in hand, when a United Airlines agent ...

read moreHotels & Resortsmore articles

7 Retreats That Help You Reconnect With Yourself

In an age of constant notifications, endless deadlines, and digital noise, it’s easy to lose touch with ourselves. Modern life often leaves us overstimulated yet ...

read moreFootballers Turned Hoteliers: The Luxury Hotels Owned by the Game’s Biggest Stars

Football is all about fast cars, private jets and million dollar mansions — but a ...

read moreHow the Right Accommodation Can Make or Break Your Trade Fair Experience

Imagine this: You’ve spent months preparing for a major trade fair. Your booth is polished, ...

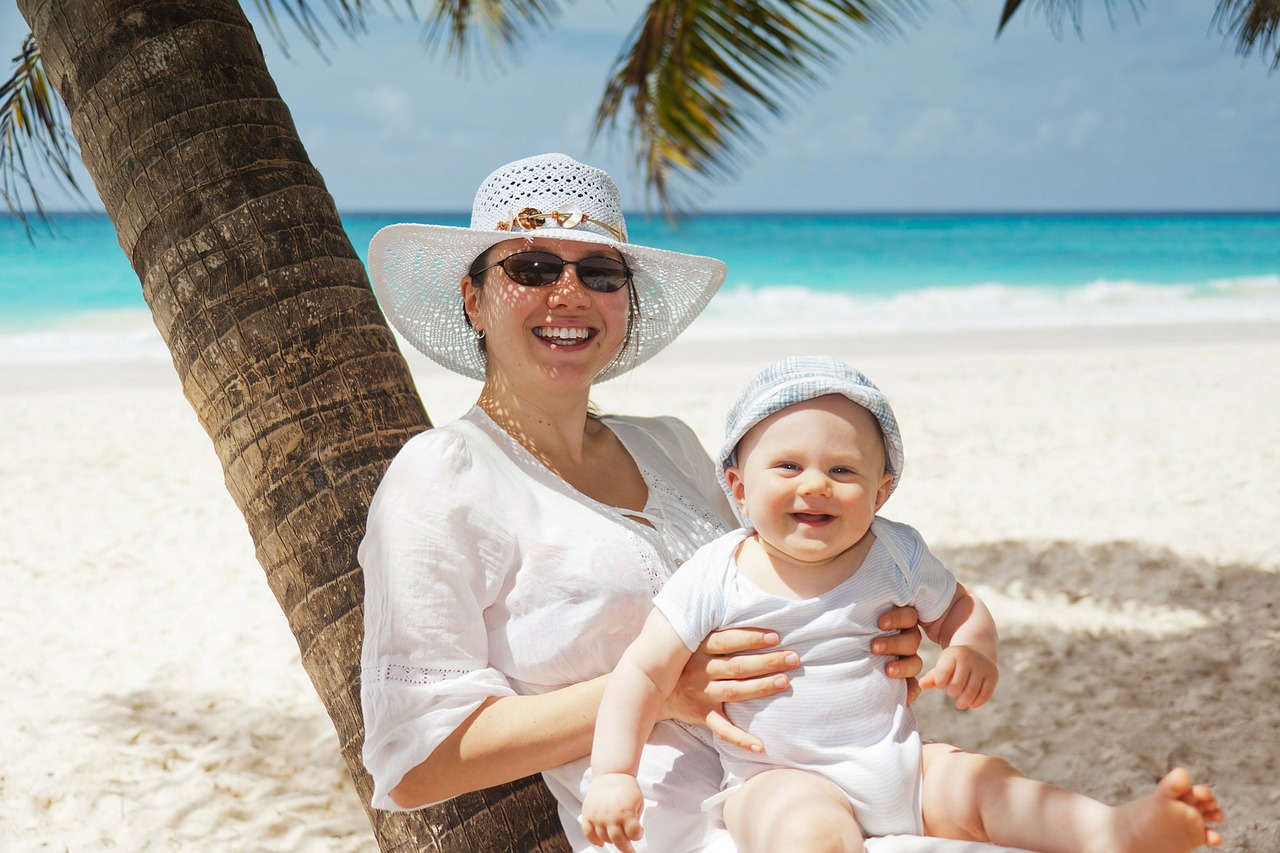

read moreIdeal Places to Stay in Riviera Maya for Large Families or Friend Groups

Looking to plan a trip of the Riviera Maya with an extended family, or a ...

read moreTechnologymore articles

Six Smart Credit Card Moves for Your Next Trip

Getting ready for a trip involves things like packing, preparing itineraries, and booking flights. But your credit card strategy also matters. The right credit card moves ...

read moreHow Video Chat Technology Enhances Solo Travel

Solo travel offers freedom and flexibility, but it can also be lonely. Video chat technology ...

read moreWhere Do Celebrities Meet: Offline vs Online, and Do They Use Dating Sites?

If you’ve ever looked at a red carpet couple and thought, “Okay, but where did ...

read moreCloud-First Platforms: The Backbone of Business Agility

Agility is no longer just an advantage — it’s a way of life. In an ...

read moreSports and Adventuremore articles