Digital assets have reshaped the way people handle money across borders. Whether you are exploring new countries, working remotely, or simply trying to avoid expensive currency-exchange desks, crypto offers flexible ways to pay, transfer, store, and manage value while travelling. More merchants accept digital payments each year, mobile wallets have become more intuitive, and blockchain networks enable global fund transfers with greater transparency.

For newcomers, international mobility is often their first real-world experience with digital assets, which can also spark broader questions about the industry, such as what is leverage trading crypto or how different blockchain tools function. Yet, travel remains one of the most practical examples of how crypto can streamline daily life.

Using crypto abroad requires preparation, awareness of local rules, and an understanding of how to protect your funds. This guide explains safe, realistic, and legally conscious ways to use crypto when travelling internationally, along with key considerations to ensure smooth movement from one country to another.

Understanding local regulations before you travel

Every destination manages digital assets differently, and the rules you encounter abroad may vary from what you are used to at home. Some countries support crypto-friendly innovation, while others have restricted use cases. Regulations can change quickly, which means travellers should review the most recent guidance before engaging in any activity.

There are a few essential points to research. First, confirm whether digital assets are legally recognised for personal transactions. Even if merchants are allowed to accept crypto, some jurisdictions require tax reporting for each transaction. Second, evaluate rules surrounding exchanges and on-ramps. Certain countries restrict access to foreign platforms, which can influence how you deposit or withdraw local currency. Third, investigate whether customs or tax authorities require the declaration of digital assets under existing reporting frameworks.

Regulatory clarity is essential when travelling to markets that enforce strict financial controls. It ensures that you can use your crypto confidently and reduce the risk of unexpected compliance issues during your trip.

Preparing your wallets and accounts before departure

The way you prepare your digital assets determines how seamlessly you can use them abroad. Travellers should check the compatibility of their wallets, update apps to their latest versions, and enable strong security features such as biometrics and multi-factor authentication.

You may want to separate daily-use funds from long-term holdings. Using a mobile wallet for small transactions reduces risk if your device becomes lost or compromised. Meanwhile, personal cold-storage solutions can secure assets you do not plan to touch during the trip. Wallet backups should always be stored offline, never on a mobile device or cloud account, to minimise exposure.

It is also wise to test your wallets domestically before travelling. Make sure you can send, receive, and convert assets without delays. Some exchanges and wallets require additional verification steps when logging in from abroad, and familiarising yourself with these processes prevents last-minute issues.

Device preparation matters as well. Update your operating system, check for outdated apps, and remove any unnecessary extensions that could introduce vulnerabilities. A clean, well-maintained device significantly reduces attack surfaces.

Using crypto for everyday spending abroad

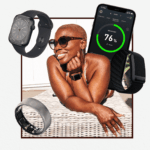

Crypto can support a wide variety of travel needs, from small retail purchases to hotel stays and local transport. Payment options vary by country, but travellers often use digital assets in three primary ways: direct payments, debit cards linked to crypto, and conversions into local currency via compliant platforms.

Direct crypto payments work best in regions where merchants openly accept digital assets. These payments are typically handled through QR codes or payment gateways that convert the asset into local currency instantly. This avoids the need to carry cash or rely on expensive currency-exchange services.

For destinations where direct crypto acceptance is limited, debit cards linked to crypto accounts offer a hybrid solution. These cards function like any regular payment card, but funds are drawn from a digital-asset balance. As long as the card network is supported in the country, travellers can pay in local currency at shops, restaurants, and ATMs. It is essential to verify regional availability and any applicable card-network restrictions before departure.

When neither of these options fits your needs, converting small amounts of digital assets into local currency through regulated channels can bridge the gap. Travellers should avoid converting large quantities at once to reduce exposure to exchange-rate fluctuations. Using official, compliant financial platforms enables funds to move safely and transparently.

Sending money internationally while travelling

One of the most substantial advantages of crypto for travel is the ability to send money across borders quickly and without excessive fees. Whether you need to receive funds from friends or family, pay a remote booking service, or reimburse someone you meet abroad, digital assets allow near-instant transfers that avoid traditional banking delays.

To send funds securely, always confirm the correct address or username before initiating a transaction. Unlike traditional banking, blockchain transactions cannot be reversed once sent to the wrong address. Send a small test amount first to verify accuracy.

Travellers working abroad, studying internationally, or moving between countries for extended periods often rely on crypto for cross-border mobility. As long as local regulations allow personal transfers, crypto can significantly reduce the friction associated with currency conversion and banking barriers.

Avoiding common risks while using crypto in foreign environments

Travelling introduces additional digital security challenges. You may connect to public Wi-Fi networks, handle unfamiliar payment terminals, or rely on devices under physical strain. Taking proactive precautions helps reduce exposure.

Avoid logging into critical accounts on open public networks. If unavoidable, use a VPN to encrypt your connection. Never store private keys or recovery phrases digitally, and do not share wallet information with anyone. If your device is lost or stolen, immediately use backup tools to secure your accounts.

Be wary of QR codes displayed in public spaces, as they may be replaced with malicious ones that redirect payments. Always verify the merchant’s authenticity and confirm details carefully before confirming a transaction.

Finally, keep your plans flexible. Some destinations may experience temporary network outages or restrictions on specific services. Having more than one wallet or payment method ensures you are not caught without a way to pay.

Understanding how travel differs from speculative behaviour

Using crypto abroad is fundamentally different from participating in speculative activity or complex trading strategies. Travellers occasionally ask questions like how to trade crypto with leverage, usually because they see the phrase online while researching digital-asset tools. It is essential to understand that these concepts are largely irrelevant when your main priority is paying for goods, navigating foreign economies, or transferring funds between countries. Travel use cases prioritise stability, accessibility, and compliance, not aggressive financial behaviour.

Focusing on practical, real-world applications ensures safer engagement. The goal is to maintain reliable access to your funds, avoid unnecessary risk, and comply with local rules. Travel is not the environment for experimental trading, short-term tactics, or high-risk strategies. Clarity about these distinctions helps create a more secure and predictable travel experience.

Handling long-term or multi-country trips using crypto

If you are travelling for several months or moving between multiple destinations, you may need additional planning. Start by tracking the regulatory status of every country you intend to visit. Some places allow crypto payments freely; others impose reporting requirements or limit access to specific platforms.

Maintaining a clear record of your transactions can also make travel smoother. When converting assets to local currency, track dates, amounts, and conversion rates. This helps avoid confusion when calculating expenses or when later meeting reporting obligations.

For extended travel, it is helpful to keep some funds in stable assets to avoid value fluctuations during your trip. However, long-term travellers should avoid storing all their funds in one format. A combination of digital assets, local currency, and a backup payment card ensures flexibility across different environments.

If you work remotely while travelling, you may also need to receive payments from clients or platforms. Make sure you understand how to withdraw or convert funds in each region. Local rules may dictate how service-related payments must be documented.

Best practices for safe and efficient crypto travel

Although each traveller has unique needs, several practices can make the experience smoother.

Maintain at least two wallets on separate devices to ensure redundancy. Keep a small daily-use balance accessible, and store additional funds offline or in a secure wallet. Enable security features on every device and log out of accounts when not in use. Download maps, wallet apps, and exchange interfaces ahead of time in case your destination has limited connectivity. Finally, always check local rules before converting or spending digital assets.

Conclusion

Crypto can significantly improve the travel experience by enabling faster transfers, convenient spending options, and transparent global value transfer. With proper preparation, secure devices, and awareness of local regulations, travellers can use digital assets safely across borders. Understanding practical use cases and recognising the difference between everyday travel needs and technical concepts, such as what leverage crypto trading is, helps keep the focus on safety and accessibility. When used responsibly, crypto becomes a powerful tool for navigating international trips with confidence and flexibility.

By

By